Keysight Technologies Inc KEYS Stock Price & Chart Trade Now

Content

Here you will find stock quotes and a chart showing the up and down trends of Keysight Technologies KEYS stock, and you can buy stock in the app at the current price. We publish analysis and forecasts to help you choose the right strategies for trading Keysight Technologies, Inc. stock today, tomorrow and in the future. Stocks and ETFs.Brokerage services for US-listed, registered securities are offered to self-directed customers by Open to the Public Investing, Inc. (“Open to the Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here.

“Alternative assets,” as the term is used at Public, are equity securities that have been issued pursuant to Regulation A of the Securities Act of 1933 (as amended) (“Regulation A”). These investments are speculative, involve substantial risks (including illiquidity and loss of principal), and are not FDIC or SIPC insured. Alternative Assets purchased on the Public platform are not held in an Open to the Public Investing brokerage account and are self-custodied by the purchaser. The issuers of these securities may be an affiliate of Public, and Public (or an affiliate) may earn fees when you purchase or sell Alternative Assets.

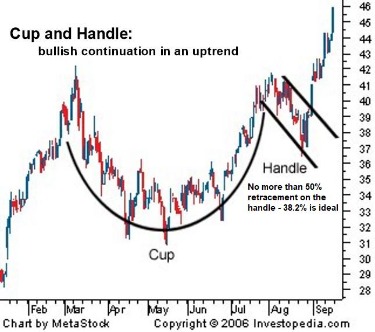

Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study.

In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest. Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style.

Services

To opt-in for investor email alerts, please enter your email address in the field below and select at least one alert option. After submitting your request, you will receive an activation email to the requested email address. You must click the activation link in order to complete your subscription. What you need to know… The S&P 500 Index ($SPX ) https://g-markets.net/helpful-articles/spinning-top-candlestick-pattern-comprehensive/ (SPY ) today is up +0.35%, the Dow Jones Industrials Index ($DOWI ) (DIA ) is up +0.36%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) is up +0.28%. Upgrade to MarketBeat All Access to add more stocks to your watchlist. Sign-up to receive the latest news and ratings for Keysight Technologies and its competitors with MarketBeat’s FREE daily newsletter.

Which stocks are major institutional investors including hedge funds and endowments buying in today’s market? Click the link below and we’ll send you MarketBeat’s list of thirteen stocks that institutional investors are buying up as quickly as they can. You can find your newly purchased Keysight stock in your portfolio—alongside the rest of your stocks, ETFs, crypto, treasuries, and alternative assets. Keysight Technologies announced that its board has initiated a share repurchase plan on Monday, November 22nd 2021, which authorizes the company to buyback $1,200,000,000.00 in outstanding shares, according to EventVestor. This buyback authorization authorizes the company to reacquire up to 3.3% of its shares through open market purchases.

The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. ‘B’ score indicates good relative ESG performance and above average degree of transparency in reporting material ESG data publicly. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. The Barchart Technical Opinion rating is a 40% Buy with a Weakest short term outlook on maintaining the current direction. A sharp acceleration in revenue and earnings growth makes this stock a top 5G pick. The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s.

Keysight Technologies Inc. stock rises Thursday, still underperforms market

For example, a price above its moving average is generally considered an upward trend or a buy. Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

- The technique has proven to be very useful for finding positive surprises.

- Sign-up to receive the latest news and ratings for Keysight Technologies and its competitors with MarketBeat’s FREE daily newsletter.

- Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

- To see all exchange delays and terms of use please see Barchart’s disclaimer.

A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. See the current value of Keysight Technologies, Inc. (Keysight Technologies) shares.

Other Stocks

Keysight serves the telecommunications, aerospace/defense, industrial, computer, and semiconductor sectors. The company was founded in 2014 and is headquartered in Santa Rosa, CA. 12 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for Keysight Technologies in the last twelve months. There are currently 3 hold ratings and 9 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should “moderate buy” KEYS shares. Commission-free trading of stocks and ETFs refers to $0 commissions for Open to the Public Investing self-directed individual cash brokerage accounts that trade the U.S.-listed, registered securities electronically during the Regular Trading Hours.

This segment also provides printed-circuit-board-assembly testers, integrated circuit parametric testers, and sub-nano-meter positioning sub-assemblies; and test and measurement products and software. The company offers product support, technical support, and training and consulting services. It sells its products through direct sales force, distributors, resellers, and manufacturer’s representatives. Keysight Technologies, Inc. was founded in 1939 and is headquartered in Santa Rosa, California. Alternative Assets.Brokerage services for alternative assets available on Public are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC.

Keysight Stock Earnings

Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered. Securities products offered by Open to the Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

The company’s technologies are used in wireless communications, IoT, the defense, aerospace, energy and automobile industries, etc. in over 100 countries. Seventy eight companies on the Fortune 100 list are clients of Keysight. The company was founded in 2014 by a split of Agilent Technologies (founded in 1999 on the basis of Hewlett-Packard) into two separate companies.

Shares buyback plans are usually a sign that the company’s board believes its shares are undervalued. As of May 31st, there was short interest totaling 3,040,000 shares, a drop of 16.9% from the May 15th total of 3,660,000 shares. Based on an average daily volume of 1,130,000 shares, the short-interest ratio is presently 2.7 days.

Top institutional shareholders include Perpetual Ltd (0.33%), Nordea Investment Management AB (0.32%), Confluence Investment Management LLC (0.13%), Covea Finance (0.09%), Ardevora Asset Management LLP (0.06%) and Weybosset Research & Management LLC (0.06%). 364 employees have rated Keysight Technologies Chief Executive Officer Ron Nersesian on Glassdoor.com. Ron Nersesian has an approval rating of 97% among the company’s employees. This puts Ron Nersesian in the top 30% of approval ratings compared to other CEOs of publicly-traded companies.

Keysight Technologies issued an update on its third quarter earnings guidance on Tuesday, May, 16th. The company provided earnings per share (EPS) guidance of $2.00-$2.06 for the period, compared to the consensus EPS estimate of $1.96. The company issued revenue guidance of $1.37-$1.39 billion, compared to the consensus revenue estimate of $1.39 billion.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.17% per year. These returns cover a period from January 1, 1988 through May 15, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month.

For more information on risks and conflicts of interest, see these disclosures. An affiliate of Public may be “testing the waters” and considering making an offering of securities under Tier 2 of Regulation A. No money or other consideration is being solicited and, if sent in response, will not be accepted. No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC. An indication of interest to purchase securities involves no obligation or commitment of any kind.

Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. The technique has proven to be very useful for finding positive surprises.

Leave a Reply